The Return of Normal

If you’re contemplating making the move you know you need to, one of the biggest questions you may have is this: what’s happening with home prices?

Let’s be clear: home prices aren’t falling. It’s just that price growth is beginning to return to normal. Here’s the context you need to understand the trend.

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

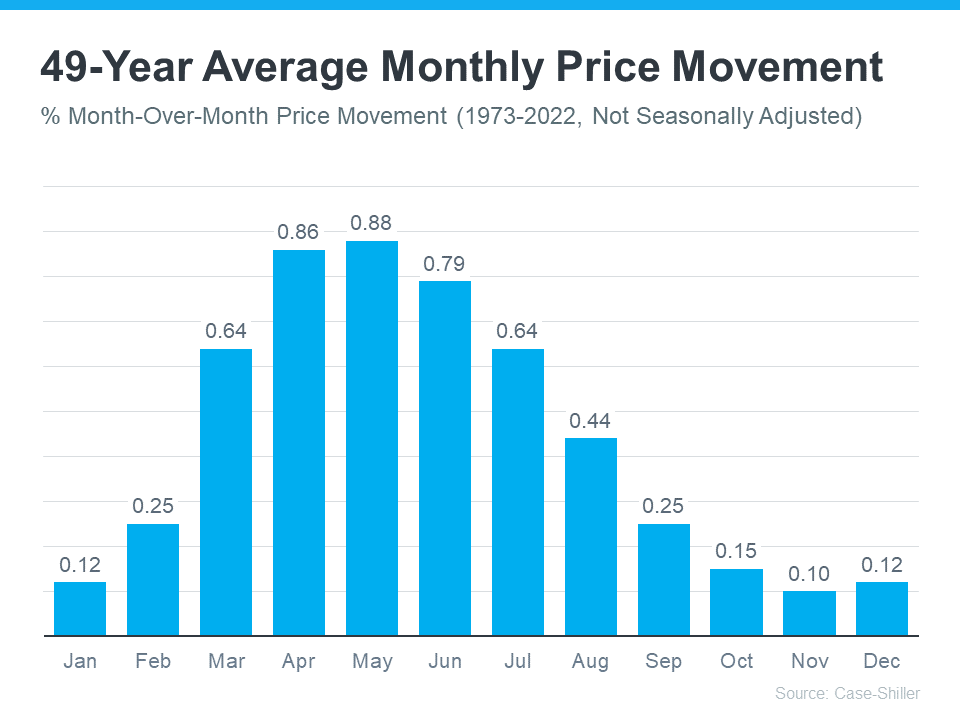

That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality. As Selma Hepp, Chief Economist at CoreLogic, explains: “High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages…Home prices are still growing, but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Please remember that many of the so called financial experts, who you follow on your favorite cable news network or podcast, aren’t experts in the the real estate market. They’re generalists who talk one week about how much life insurance you should have and the next about the best places for bargain vacations.

Bottom Line

After unprecedented upheaval in the real estate market (and elsewhere) normal patterns and conditions are beginning to re-emerge. With inventory tight and buyer demand still strong this, remains as good a time as any to make a change, whether your home has gotten too small for your growing family or too big, because you’re an empty nester.

Need to talk it through? We’re happy to listen. Let’s connect at 508-360-5664 to start the conversation…

Mari and Hank

”

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass