Saving for a Down Payment? Here’s What You Need To Know

If you’re planning to buy your first home, you’re probably focused on saving for all the costs involved.

One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case.

As the National Association of Realtors (NAR) notes: “One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed.”

A recent Freddie Mac survey found that: “…nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Here’s the good news. Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize.

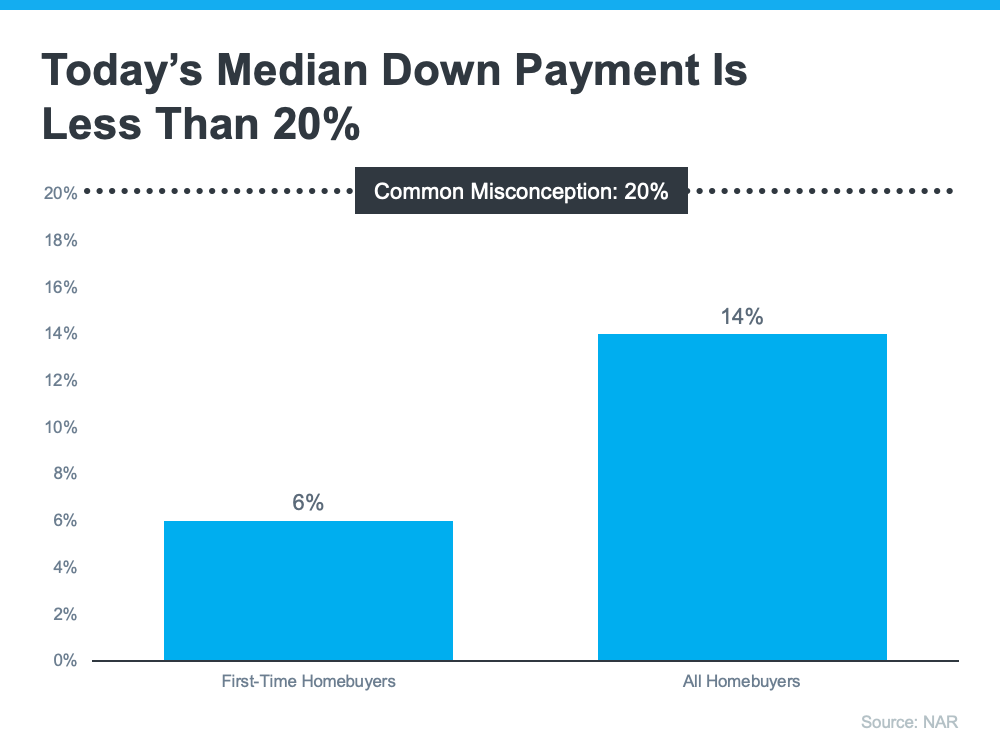

According to NAR, the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

What does this mean for you? It means you may not need to save as much as you originally thought.

Learn About Options That Can Help You Toward Your Goal

And it’s not just how much you need for your down payment that isn’t clear. There are also misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too.

According to Down Payment Resource,there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. That same resource goes on to say: “Over 38% of all [programs are for repeat homebuyers who have owned a home in the last three years.”

If you’re interested in learning more about down payment assistance programs, please get in touch with us. We work with many reputable lenders who can provide you with the information you need. Let’s connect at 508-360-5664 or [email protected]. We’re happy to help.

Talk soon…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass