Buyers More Active than in Pre-Pandemic Days

We really don’t want to keep picking on good old Uncle Bob “who knows a little something about real estate.” Or the parade of TV talking heads and social media posters, who continue to offer negative advice about the current housing market.

But, here’s something you should know that they’re not telling you: buyers have adjusted to the higher — but still very low — mortgage interest rates and are getting on with their lives.

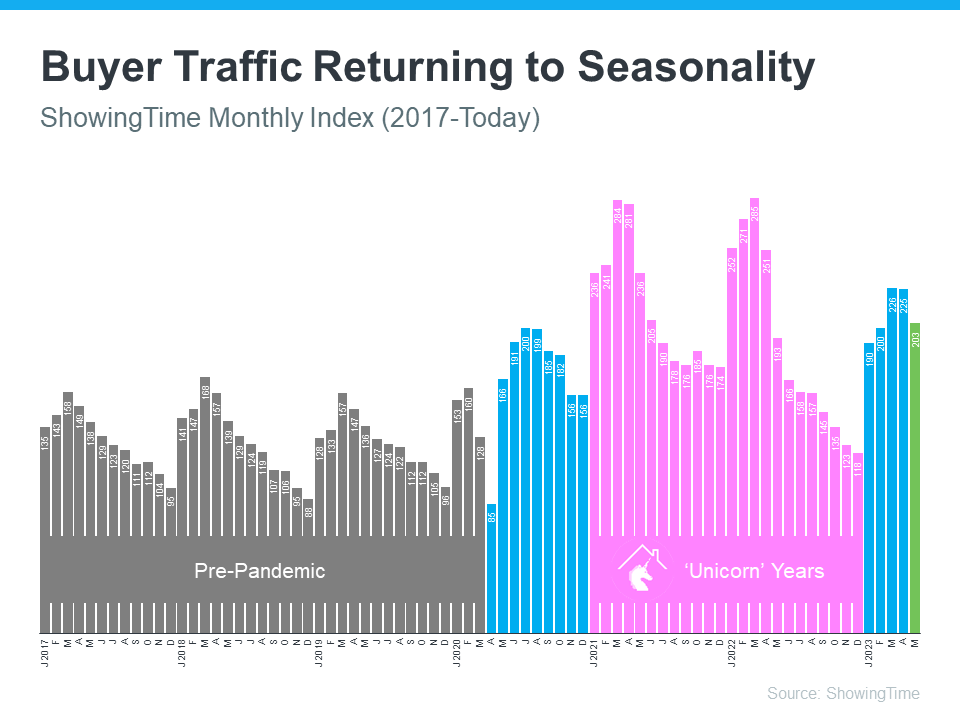

The ShowingTime Showing Index is a measure of how much buyers are touring homes. The graph below uses that index to illustrate buyer activity trends over time to help put today into the proper perspective.

It shows there’s seasonality in real estate. If you look at the last normal years in the market (shown in gray), there was a consistent pattern as buyer activity peaked in the first half of each year (during the peak homebuying season in the spring) and slowed as each year came to a close.

When the pandemic hit in March 2020, that trend was disrupted as the market responded to all the uncertainty (shown in blue in the middle). From there, we entered the ‘unicorn’ years of housing (shown in pink). This was when mortgage rates were at record-lows and buyer demand was sky high. Similar seasonal trends still existed even during that time, just at much higher levels.

Now, let’s look at 2023. Traffic is down when compared to the peak unicorn months, But what’s happening isn’t a steep drop off in demand – it’s a slow return toward more normal seasonality.

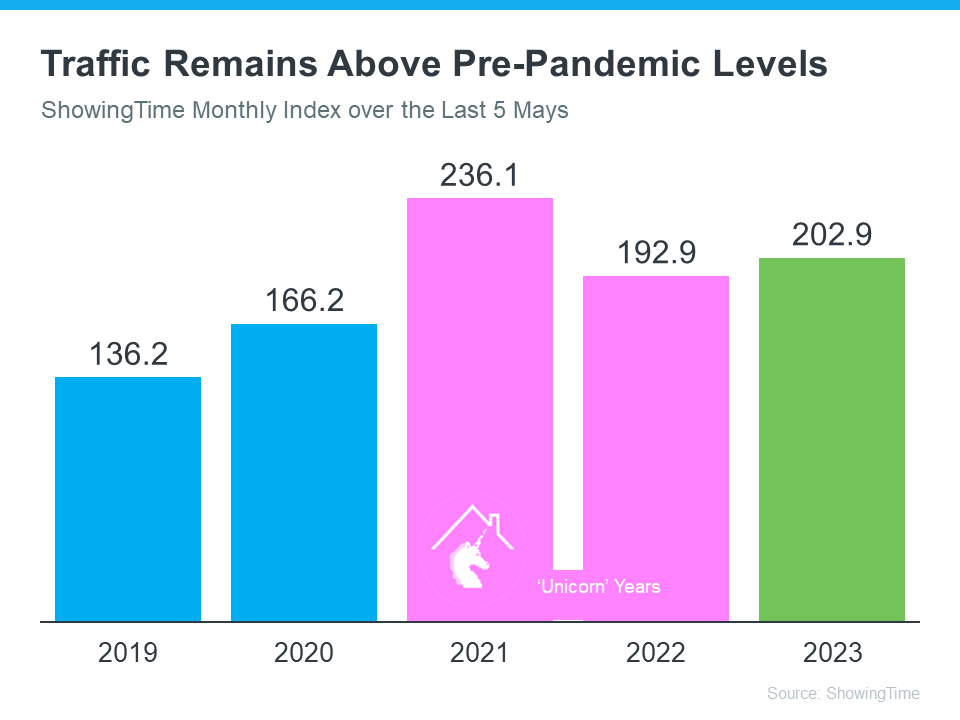

And, to highlight this isn’t a drastic decline, let’s zoom in. Here’s a graph using just the May data for the last five years. It shows just how strong buyer demand still is.

What Does That Mean for You?

Buyers are out there touring homes. They’re more active than they were in May 2022 (when sticker shock over higher mortgage rates started to set in) and certainly more than they were in the last normal years. Buyer activity could actually be even stronger if it wasn’t constrained by the limited supply of homes for sale.

So, once again, if you have entertained any thoughts of selling, now is the time to explore your options before competition increases, as it inevitably will.

As we mentioned in our post last week, we were participating later that day in a webinar featuring Steve Harney, one of the country’s leading real estate economists, to discuss consumer hesitancy about the housing market when evidence suggests things are moving in the right direction.

According to Harney, while there was always a steady, but relatively small percentage of consumers who said in 2022 that they expected a crash, that number shot up to over 30% in a December 2022 survey.

The reason? According to Steve, the experts got it wrong and scared the public.

Not just the gloom and doom headline grabbers, but also some respected experts, who interpreted the returning seasonality to the market as a sign of something worse.

As a result, consumers opted to do nothing, even though they needed to be doing something.

We’re certainly not economic experts, but can confirm based on many conversations with potential buyers and sellers that Steve’s conclusion is spot on.

The challenge for us as real estate professionals is to assure you that the market is moving in a positive direction and that Uncle Bob or some unknown internet poster have it wrong.

If you’d like to talk about what’s happening in the market right now, please reach out. Call us at 508-360-5664 or send us an email at [email protected]. Thanks…

Mari and Hank

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass