What's Ahead for the Remainder of 2024

Mostly everyone has an opinion on the housing market. From your Uncle Bob, who bought a house 20 years ago, to your best friend, who watches cable news.

But, here’s what the actual experts say you should expect for home prices, mortgage rates, and home sales for the rest of 2024.

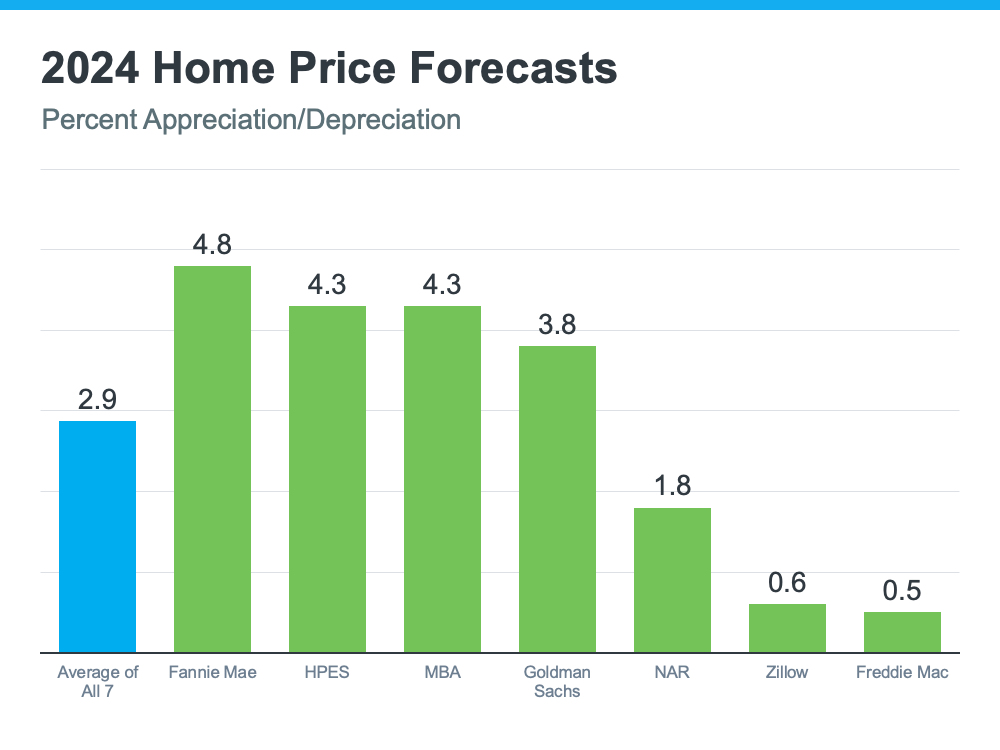

Home Prices Are Expected To Climb Moderately

Home prices are forecasted to rise at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the housing industry:

The reason for continued appreciation? The supply of homes for sale. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says: “One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have (enough) housing inventory.”

While inventory is up when compared to the last couple of years, it’s still low overall. And because there still aren’t enough homes to go around, that’ll keep upward pressure on prices.

If you’re thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. But, just remember, prices aren’t expected to drop. They’ll continue climbing, just at a slower pace.

Not everyone understands this. (Especially in the media.) While you may see a report that prices are dropping, what’s actually happening is that over-inflated asking prices are being adjusted to reflect what buyers are willing to pay. Prices will still be higher than they were a year or two ago.

So, getting into the market sooner rather than later could still save you money in the long run. Plus, you can feel confident as experts say your home will grow in value after you buy it.

Mortgage Rates Are Forecast To Come Down Slightly

One of the best pieces of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR (see chart below):

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates will bring more buyers into the market creating competition. Plus, it may help you get off the fence, if you’ve been hesitant to sell because of today’s rates.

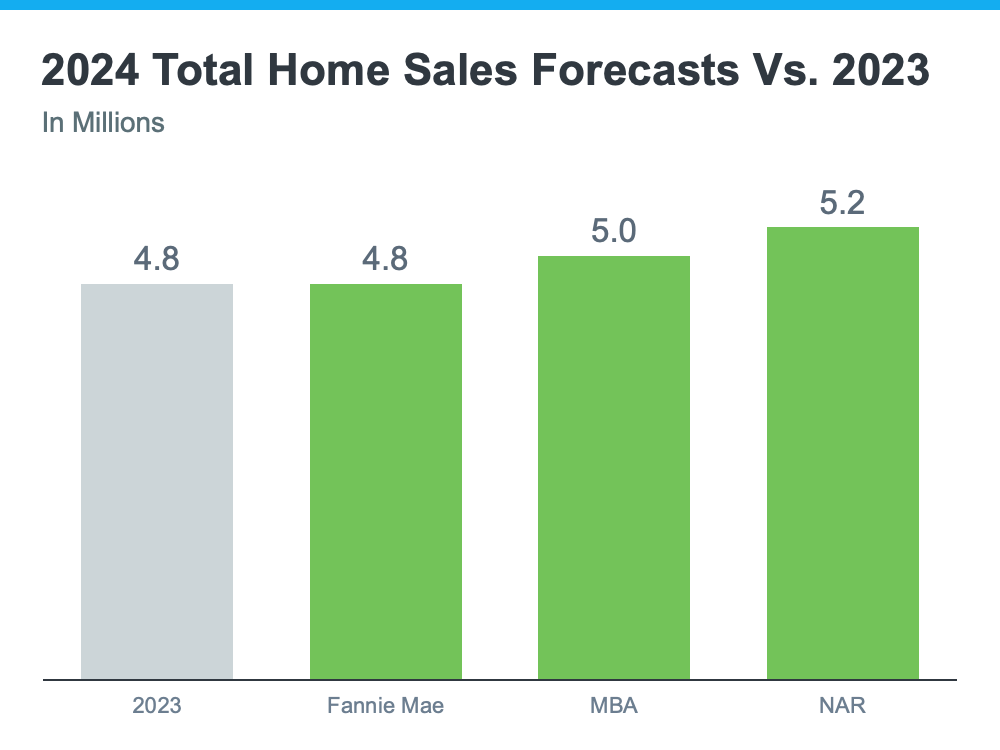

Home Sales Are Projected To Hold Steady

For 2024, the number of home sales will be about the same as last year and may even rise slightly. The graph below compares the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes that sold last year:

The average of these forecasts is about 5 million sales in 2024 – a small increase from 2023. Lawrence Yun, Chief Economist at NAR, explains why: “Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates expected to go down, more homes are expected to be sold this year compared to last year. This means more people will be able to move.

Bottom Line

We’re aware of buyers/sellers, who have decided to upsize, downsize, or just move on, but have been hesitating because of interest rates and prices. Some are also waiting to see the results of the upcoming election. (More on that in next week’s post.)

But, with prices expected to increase (not decrease) and interest rates staying more or less steady, why continue the wait?

Let’s connect at 508-360-5664 or [email protected] to discuss your options. If you move forward now, you could be in your new home by the end of summer!

The Fourth of July is later this week. Please celebrate safely and keep an eye on the young and not so young. Our area has already seen too many tragedies at the start of the summer season.

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence.

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass