Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers. If you’re someone who started the process of searching for a home, maybe you put your search on hold because the challenges felt like too much to tackle. You’re not alone in that.

A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were: 1) their offers were unsuccessful or in some cases they just couldn’t compete; 2) they couldn’t find anything in their price range, and 3) they couldn’t find the right home.

If any of these sound like why you stopped looking, here’s what you need to know. The housing market is in a transition in the second half of 2024. Here are three reasons why this may be your chance to jump back in.

1. The Supply of Homes for Sale Is Growing

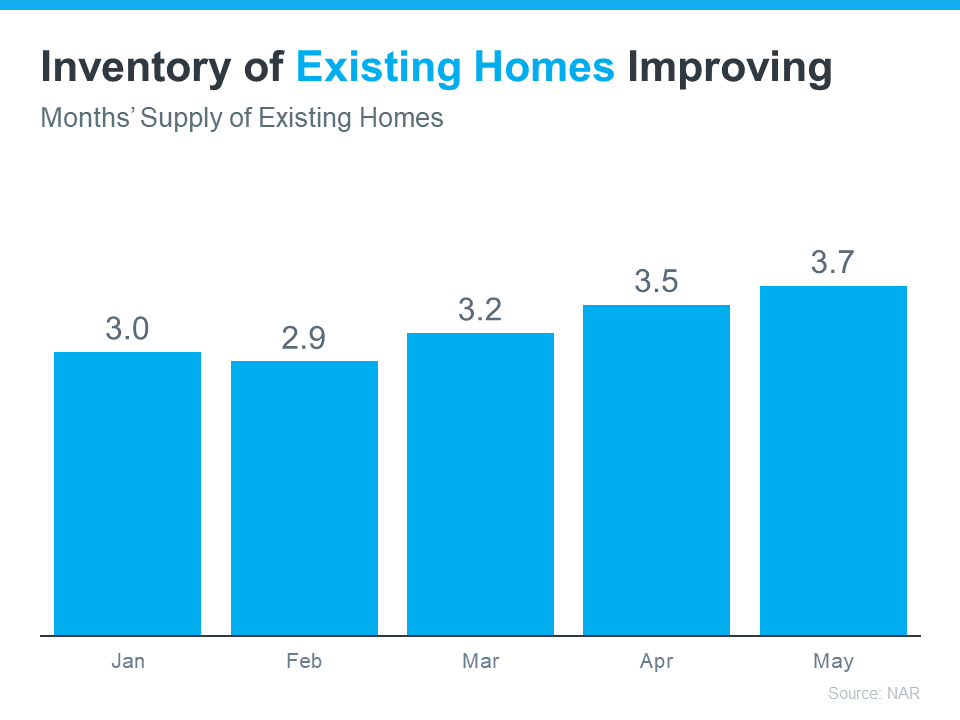

One of the most significant shifts in the market this year is how the monthly supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph below):

This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear.

On Cape Cod, the supply of homes for sale rose from 489 in June 2023 to 682 for this June. That’s an increase of 39.5%. While we obviously need more homes for sale, this is an encouraging trend.

This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief.

2. Less Buyer Competition

Mortgage rates are still hovering in the 6% range, so buyer demand isn’t as fierce as it once was. When you combine that with more housing supply, you have a better chance of avoiding an intense bidding war.

Danielle Hale, Chief Economist at Realtor.com, says the positive trend for the latter half of 2024 means that “Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”

This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price.

Anecdotally, we can report that Open Houses are not as busy as they once were and multiple offer situations are not as frequent.

3. Home Prices Are Moderating

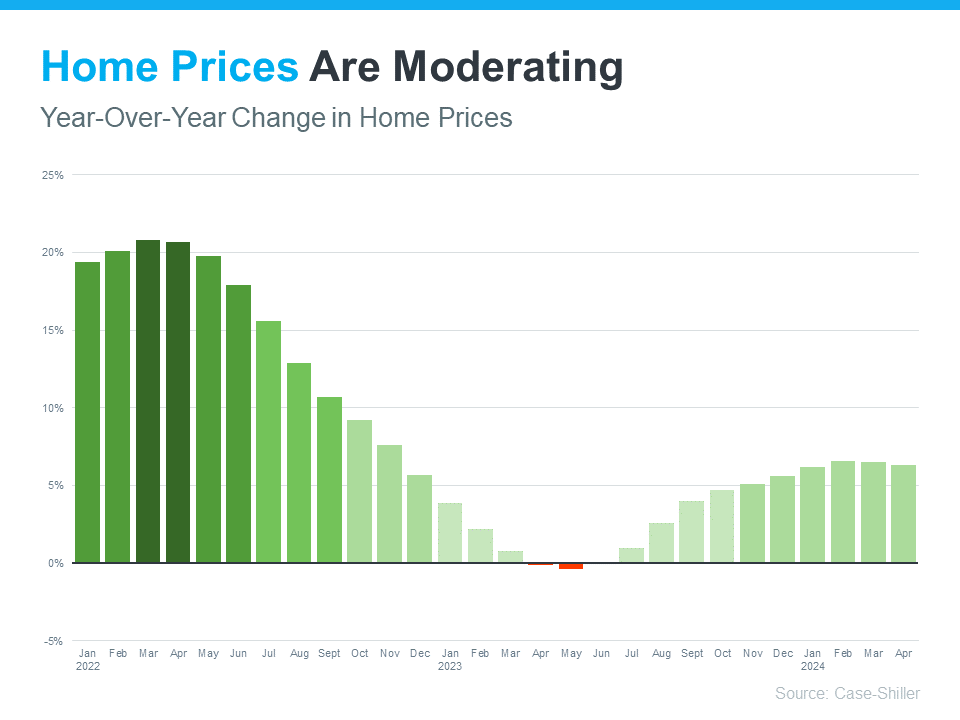

Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below):

On Cape, home prices are up about 7% when comparing this June to last.

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace.

Every now and then someone tells us that they’re waiting for prices to drop, but there’s no indication that will happen. However, some sellers are still acting as if it were a few years ago and are setting unrealistic asking prices. When they are reduced that doesn’t mean prices are falling, it just means that sellers are finally adjusting asking prices to market realities. The final sales price will still be more than what the seller paid.

(Many in the media don’t understand this, so you will continue to see inaccurate reports about prices falling.)

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago.

The Opportunity in Front of You

If you’re ready and able to buy, you may find that it’s a bit easier time to navigate. There are still challenges, but some of the biggest hurdles you may have faced are getting better as time wears on.

You could wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers.

If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Let’s connect at 508-360-5664 or [email protected] to talk more about the opportunities you have in today’s market.

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass