Waiting for Foreclosures Before Making a Change?

It is both puzzling and concerning to us that in a recent survey a sizeable number of Americans said that they believe that the housing market is going to crash.

With demand for homes remaining high and the number of houses available low, simple economics says that a crash is not imminent.

No one should be rooting for prices to fall as it’s not in anyone’s best interest for their neighbors, friends and family to lose money. For most of us, our homes are our single largest investment and represents our retirement fund, tuition for our children and grandchildren, etc.

It would seem that too many are listening to their Uncle Bob who bought a house 20 years ago or the so-called experts on cable TV and social media who have something to gain from the controversy they create.

We remember all too well the “experts” who predicted a wave of foreclosures during the pandemic. (Didn’t happen.)

We also recall conversations with clients who said they were putting their plans on hold because they were waiting for foreclosures. They’re still waiting.

Here’s a look at why the data and the experts say a wave of foreclosures is not going to happen.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgages

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even when they couldn’t show they’d be able to pay them back. At that time, lenders weren’t being as strict when looking at applicant credit scores, income levels, employment status, and debt-to-income ratio.

But since then, lending standards have gotten a whole lot tighter. Lenders became much more diligent when assessing applicants for home loans. And that means we’re seeing more qualified buyers who have less of a risk of defaulting on their loans.

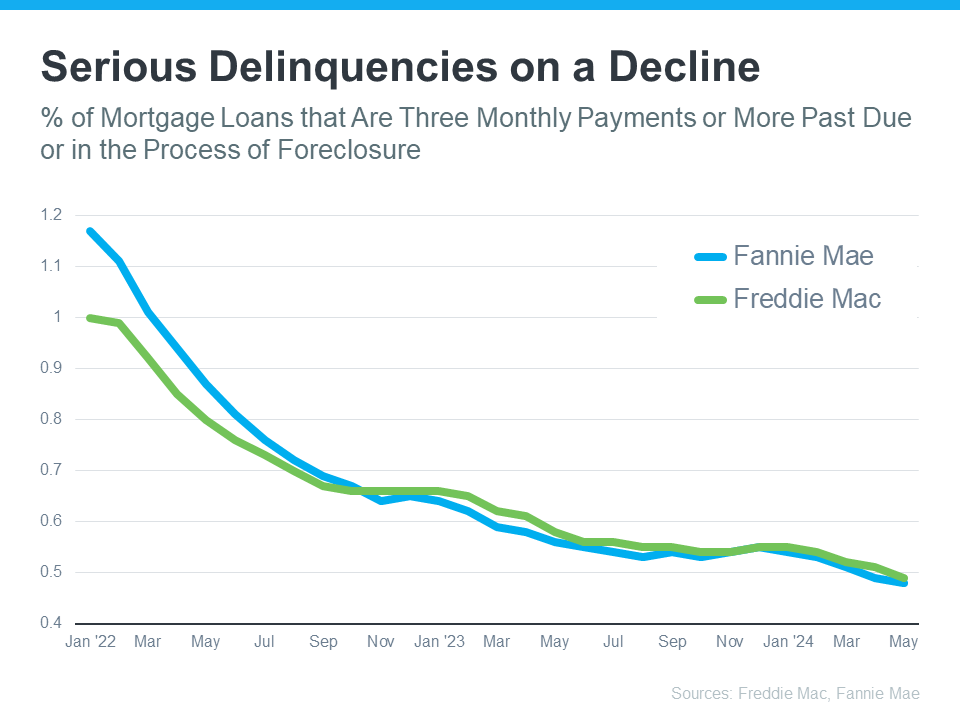

That’s why data from Freddie Mac and Fannie Mae shows that the number of homeowners who are seriously behind on their mortgage payments (known in the industry as delinquencies) has been declining for quite some time. Take a look at the graph below:

What this means is that, not only are borrowers more qualified, but they’re also finding ways to navigating through short-term challenges, exploring their repayment options, or maybe even using the record amount of equity they have to avoid foreclosure entirely.

How much equity?

With that much equity, the typical homeowner is also in a good position to use it and make the change that they have been delaying. Upsizing, downsizing or maybe moving to that “someday” place is actually a real possibility.

Bottom Line

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise significantly. But, since so many buyers are making their payments today and homeowners have so much equity built up, a wave of foreclosures isn’t likely.

Take it from Bill McBride of Calculated Risk – an expert on the housing market who, after closely following the data and market leading up to the crash, was able to see the foreclosure crisis coming in 2008.

McBride says: “We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.”

Have you been delaying the change you know you need to make? We’re here to help. We’ve sold over 400 homes over 25 years — including our own — and can guide you through the changing buying and selling process.

Let’s connect at 508-360-5664 or [email protected] to talk about your plans.

Mari and Hank

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass