Are Investors Really Buying That Much Property?

We’re sure you’ve heard that “big investors” are gobbling up all the single family homes that are for sale. The story goes that’s one of the reasons why prices are increasing which is making it harder it harder for you to buy a home.

Is that true?

In a word, no.

Here’s the truth. Investor purchases are actually on the decline, and the big players were never as active as the stories lead you to believe. Let’s dive into the facts and put this myth to rest.

Most Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains: “On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are “mom-and-pop” who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who may have rental property or a second home in a warmer climate.

Investor Home Purchases Are Dropping

But what about the big investors you hear about? Lately, those institutional investors – the ones that make headlines – have pulled back and aren’t buying as many homes.

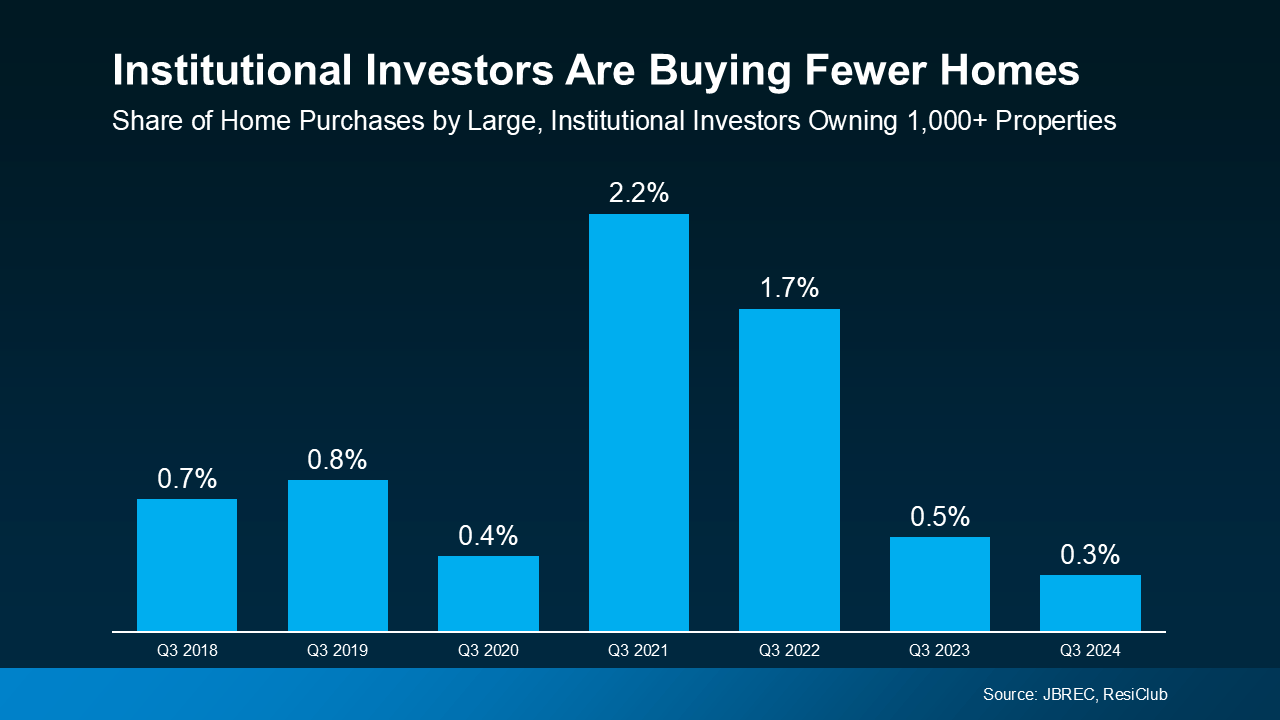

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

Investors are clearly more reluctant to buy in today’s market, but why? The answer is largely because higher mortgage rates and home prices have made it less attractive for them.

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re not nearly as active as they were in past years.

Bottom Line

No matter what the talking head on your favorite cable news channel is saying institutional investors aren’t buying up all the homes – if anything they’re buying less than they were and that wasn’t much to begin with.

So, maybe your favorite Uncle Bob who “knows a little something about real estate” doesn’t have this one quite right.

Let’s connect and talk about what’s happening here on Cape and over the bridge. Today Real Estate has realtors stationed all over New England who can help you find where’s next for you.

There could be more opportunities than you think.

Mari and Hank

The information contained and the opinions expressed in this article are not intended to be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision.

Categories

- All Blogs

- Cape Cod

- climate change

- Condominiums

- Down Payment

- Economy

- Food

- Home buyers

- Home buying tips

- Home Sellers

- Homeowners

- Housing Supply

- kcm crew

- Make Your Move with Mari

- Mari Sennott Plus

- Mortgage Interest Rates

- National Association of Realtors

- Ownership Goals

- Real Estate

- Realtor.com

- Sandwich, Mass